Managing personal finances can be daunting, especially for students who are juggling schoolwork, part-time jobs, and social life while also trying to keep track of their spending. Learning to budget early on is an essential skill that can set the foundation for financial success in the future. Luckily, there are a variety of budgeting apps designed to make the process easier. But with so many options out there, it can be tough to choose the right one. In this review, we’ll look at some of the best budgeting apps for students, breaking down their features, pros, and cons to help you find the perfect fit for managing your finances.

Why Budgeting Matters for Students

For students, budgeting isn’t just about managing bills—it’s about making sure that you can afford your essentials while still having room for fun and savings. Without a proper budget, it’s easy to overspend on non-essential items like fast food, entertainment, or impulsive purchases. The consequences can lead to credit card debt, anxiety, or unnecessary stress. A budgeting app can help by tracking income and expenses, setting savings goals, and offering insight into where your money is going.

The Best Budgeting Apps for Students

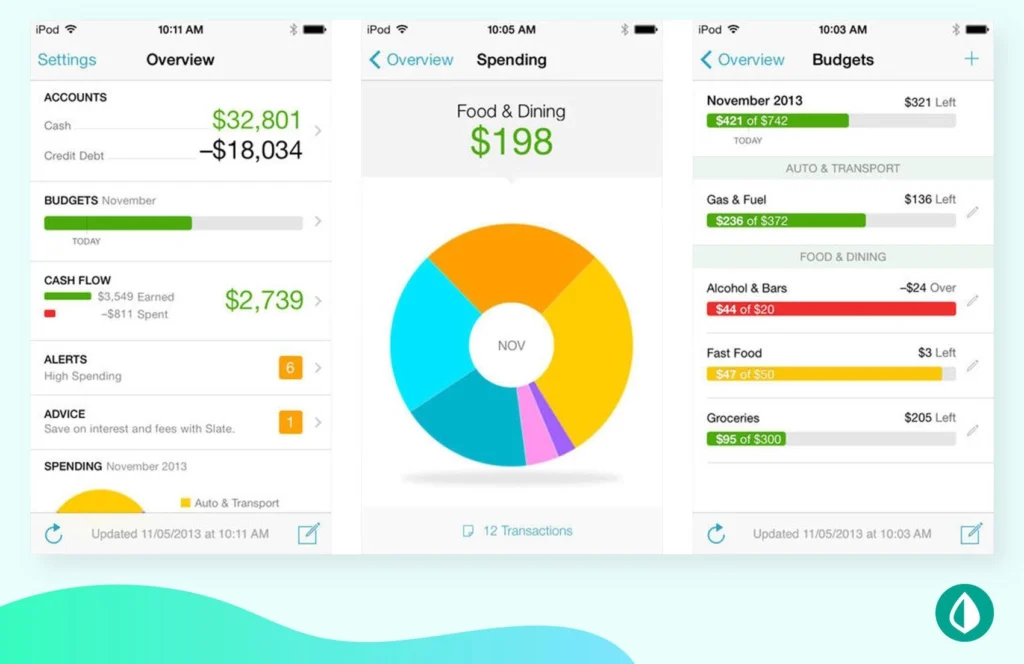

- Mint: The All-in-One Finance Tracker

Mint is one of the most popular and widely used budgeting apps out there. It’s known for its user-friendly interface and comprehensive features, making it a great option for students who are just starting to learn about budgeting. The app is completely free, which is an added bonus for students on a tight budget.

Key Features

- Expense Tracking: Mint automatically tracks your spending by syncing with your bank accounts and credit cards, categorizing transactions into categories like groceries, dining, and entertainment.

- Budget Creation: Mint allows you to set monthly budgets for each category based on your spending habits, with suggestions for how to allocate your money.

- Bill Tracking and Alerts: Mint can track bills and send you reminders when payments are due, which helps ensure you never miss a payment.

- Credit Score Monitoring: The app provides a free credit score update, so you can keep an eye on your credit while managing your finances.

- Goal Setting: Mint lets you set financial goals, such as saving for a new phone or an emergency fund, and tracks your progress.

Pros

- Free and comprehensive

- Automatically syncs with bank accounts, credit cards, and loans

- Clear and simple visualizations of your finances

- Offers both budgeting and credit score monitoring

Cons

- Ads and promotions can be intrusive, especially since it’s a free app

- Data sync issues occasionally arise

- No cash transaction tracking (unless manually inputted)

Best For: Students who want a simple, free app with all the essential features of budgeting and financial monitoring. Mint is ideal for students who prefer a set-it-and-forget-it approach with automatic syncing.

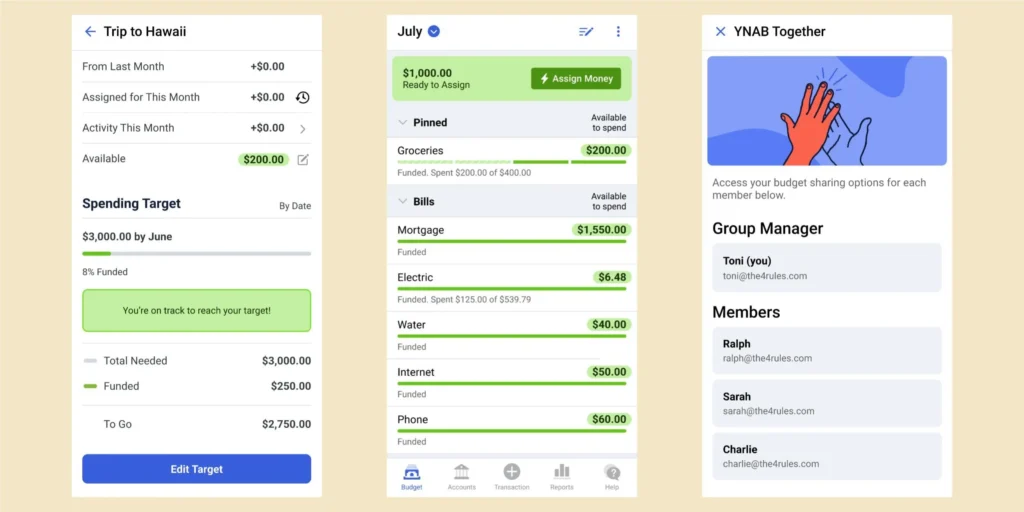

- You Need a Budget (YNAB): Master Your Money

You Need a Budget, or YNAB, is a budgeting app that takes a more hands-on approach to managing money. YNAB is built around the idea that you should give every dollar a job, helping users to prioritize their spending and save for future goals. YNAB is particularly suited for students who are ready to dive deeper into managing their finances.

Key Features

- Zero-Based Budgeting: YNAB’s main principle is the zero-based budgeting method, where you assign every dollar you earn to a specific category (such as rent, groceries, or savings) so that you’re never caught off guard.

- Goal-Oriented: YNAB helps you set clear financial goals and provides insight into how to allocate money to achieve them, such as saving for textbooks or planning a summer vacation.

- Live Tracking: YNAB tracks spending in real time, ensuring that you are always aware of your financial standing.

- Educational Resources: YNAB offers comprehensive tutorials, webinars, and a supportive community to help users learn how to budget effectively.

Pros

- Extremely detailed budgeting tools

- Helps you prioritize saving, even on a tight student budget

- Provides educational resources for learning personal finance

- Syncs across devices, so you can track your budget from anywhere

Cons

- Paid subscription (Free 34-day trial, but after that, it costs $14.99/month or $99/year)

- Has a learning curve due to its complex features

- Not as automated as other apps (requires more manual input)

Best For: Students who are serious about mastering their finances and are willing to invest in a paid app to get more control over their budgeting. YNAB is perfect for those who are looking to learn more about budgeting and take a proactive approach to saving.

- GoodBudget: A Digital Envelope System

GoodBudget is a simple, envelope-style budgeting app that allows you to set aside virtual “envelopes” for different categories (like groceries, entertainment, and rent). This makes it ideal for students who want to manage their spending in a more structured way without feeling overwhelmed by advanced features.

Key Features

- Envelope Budgeting: GoodBudget lets you create envelopes for different categories of your budget. Once money is allocated to each envelope, you track how much you’ve spent and how much is left.

- Cloud Syncing: You can sync your budget across multiple devices, so if you have a roommate or family member contributing to the household budget, everyone can stay on the same page.

- Debt Tracking: The app helps you track your debts and make a plan to pay them off, which is essential for students managing loans or credit card balances.

- Cash Management: GoodBudget allows users to manage both cash and card transactions, which is especially helpful if you’re trying to avoid overspending on your debit card.

Pros

- Simple to use, no complex features

- Works for both cash and electronic transactions

- Free version available with basic features

- Syncs across devices for collaborative budgeting

Cons

- Lacks some of the automation of other apps (like Mint)

- Free version is limited to 20 envelopes; premium features require a subscription

- Requires manual input of expenses, which can be tedious

Best For: Students who prefer a hands-on, envelope-style budgeting approach and want a more visual way to track their finances. GoodBudget is ideal for users who prefer a simple, manual method of budgeting with some flexibility for collaboration.

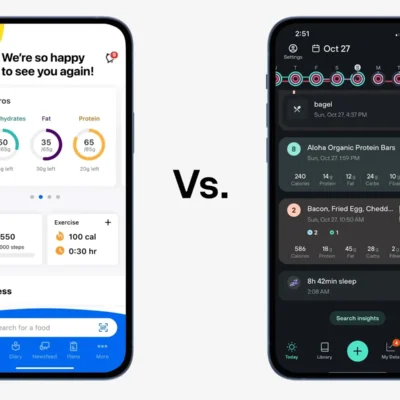

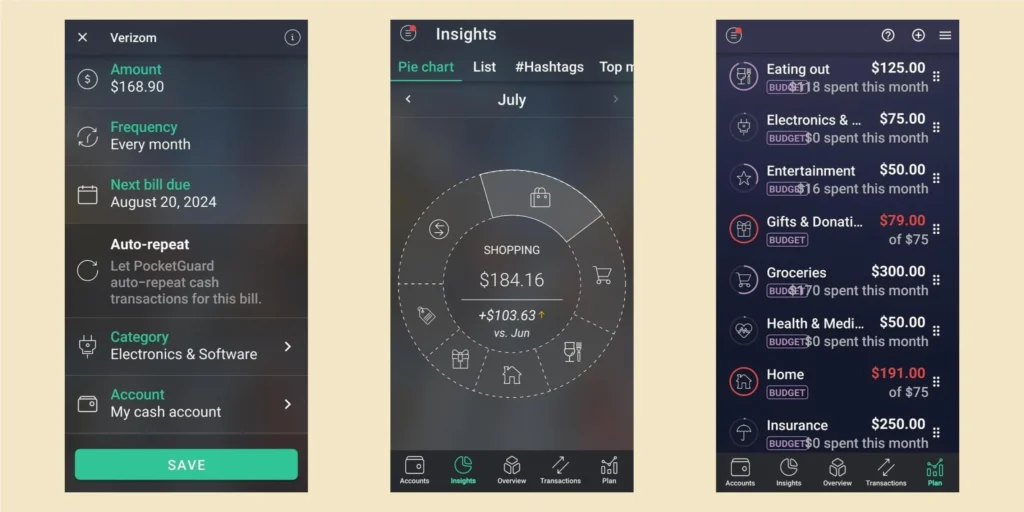

- PocketGuard: Simple and Automatic Budgeting

PocketGuard is a minimalist budgeting app that automatically calculates how much disposable income you have after accounting for your bills, goals, and necessities. It’s great for students who want a straightforward, easy-to-use app with automatic tracking and simple visualizations.

Key Features

- In My Pocket: PocketGuard automatically tracks your spending and shows you how much disposable income you have after covering bills, savings, and necessary expenses.

- Automatic Categorization: The app tracks transactions and categorizes them automatically, so you don’t have to manually input each expense.

- Goals: You can set up savings goals and track your progress toward them, whether it’s saving for a trip or building an emergency fund.

- Security: PocketGuard uses bank-level encryption to protect your financial information, giving you peace of mind while using the app.

Pros

- Extremely user-friendly and intuitive interface

- Automatic expense tracking and categorization

- Helps students understand how much discretionary spending they have

- Free version offers many useful features

Cons

- Limited customization compared to other apps

- Some features are behind a paywall (PocketGuard Plus)

Best For: Students who want a simple, automatic budgeting app that provides an overview of their finances without requiring much input. It’s perfect for those who need quick insight into their available spending money.

Conclusion: Which Budgeting App Is Best for Students?

The right budgeting app for you depends on your financial needs, preferences, and how much effort you’re willing to put into managing your money:

- Mint is best for students who want an all-in-one, free app that automates expense tracking and provides an overview of their finances.

- YNAB is ideal for students who are serious about learning personal finance and are willing to pay for a more hands-on, goal-oriented approach.

- GoodBudget works well for students who prefer the envelope system and want a simple way to control their spending without getting bogged down in complex features.

- PocketGuard is great for students who want an easy-to-use app that automatically calculates how much disposable income they have after necessary expenses.

Ultimately, the best app for you will depend on your financial goals, preferred level of involvement, and the features that matter most to you. Each of these apps can help you take control of your finances and make smarter financial decisions throughout your student years.